Lithium-Ion Battery Market Size, Share & Growth Report

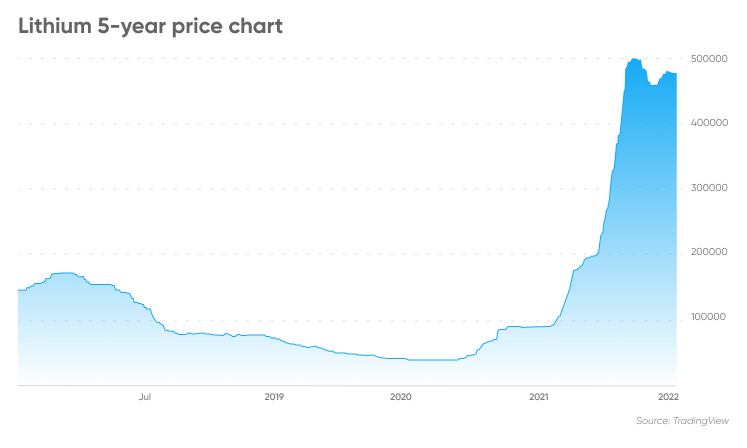

Despite the recent decline, lithium carbonate and lithium hydroxide prices, which are the key raw materials for manufacturing electric vehicle (EV) batteries, remain double the prices from early January.

The question remains whether this downtrend is merely a temporary fluctuation. This article analyses the most recent market updates and evaluates the supply-demand dynamics that impact lithium batteries.

What Are the Main Drivers of Growth in Batteries?

According to a report by Allied Market Research, the global lithium-ion battery market was valued at $36.7 billion in 2019 and is expected to reach $129.3 billion by 2027, growing at a CAGR of 18.0% from 2020 to 2027.

The report cites the growing demand for electric vehicles and stationary energy storage systems as the primary drivers of this growth.

Furthermore, a report by BloombergNEF predicts that by 2040, 58% of global passenger vehicle sales will be electric, resulting in a ten-fold increase in annual demand for EV batteries, from 110 GWh in 2020 to 1,051 GWh in 2030.

This exponential growth in demand for batteries will continue to drive innovation in battery technology and increase the efficiency and cost-effectiveness of lithium-ion batteries.

The report also notes that the increasing demand for renewable energy sources and grid stabilization is driving the growth of the energy storage system market, which is expected to reach $19.6 billion by 2025.

The use of lithium iron phosphate (LiFePO4) batteries, which offer higher safety, longer cycle life, and lower cost than other lithium-ion batteries, is expected to drive the growth of the energy storage market further.

This growth is being driven by factors such as the increasing demand for energy storage in the residential and commercial sectors, as well as the growth of the electric vehicle market.

Additionally, the supply chain for lithium-ion battery packs used in energy storage systems and other applications, such as power tools, is expanding rapidly, with companies investing in research and development to improve these batteries’ efficiency, cost, and safety.

This is creating new opportunities for lithium-ion battery supply chain companies, from raw materials suppliers to battery manufacturers and pack assemblers.

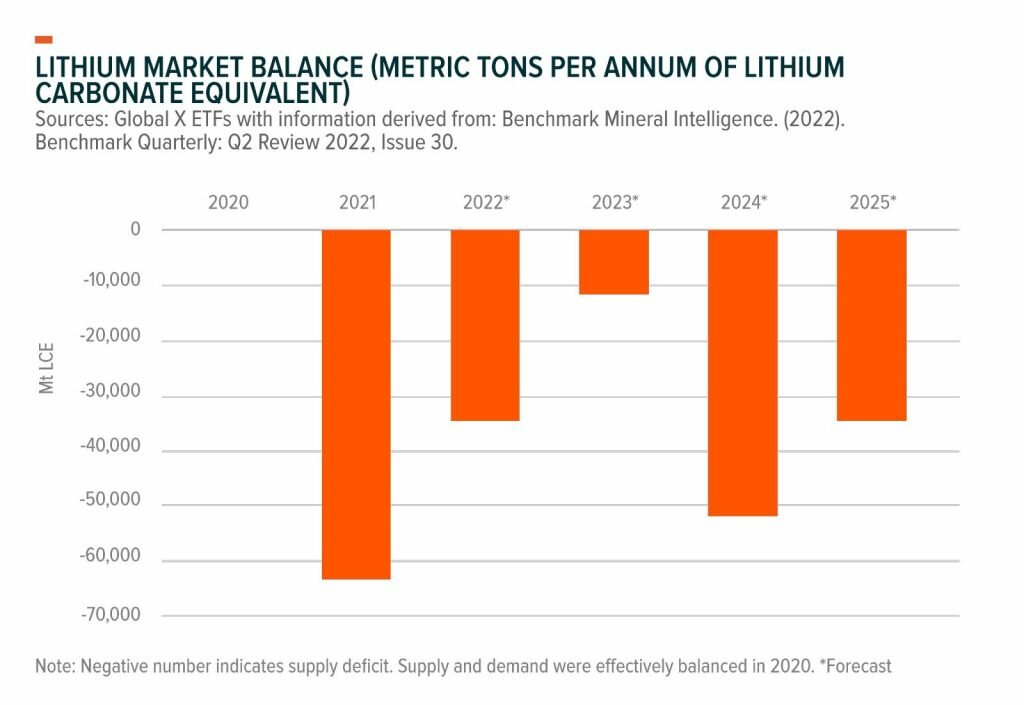

The Market Balance Forecasts Showes That the Demand for Lithium Is Expected to Exceed the Supply

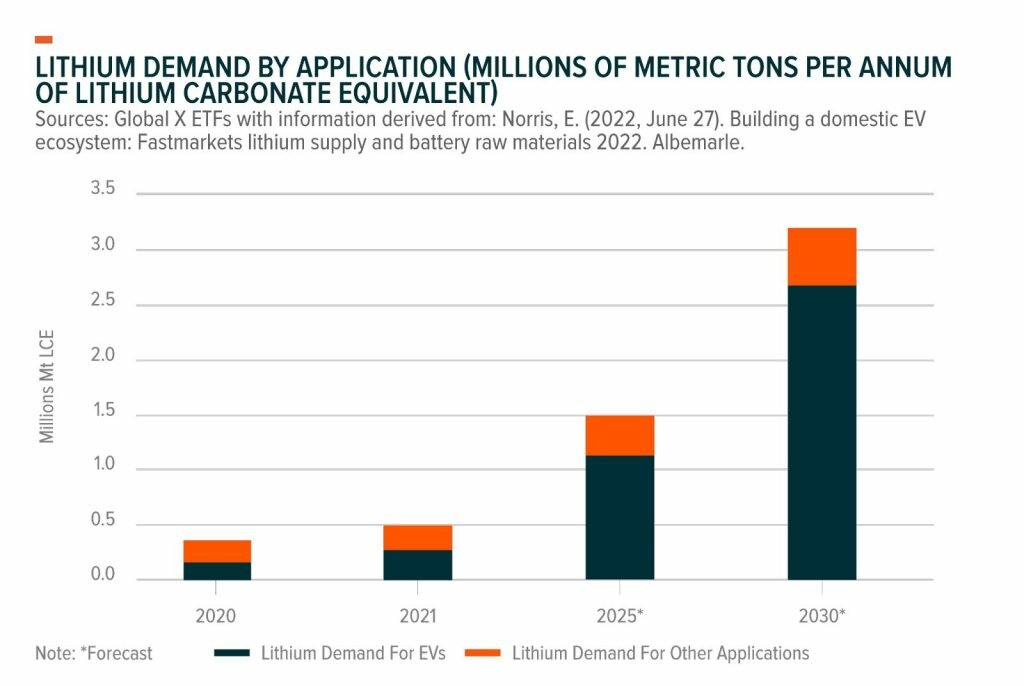

The estimated lithium demand is set to exceed 1.5 million metric tons of lithium carbonate equivalent annually by 2025 and surpass 3 million tons by 2030. This projection for 2025 indicates a threefold increase in demand from 2021.

By 2030, electric vehicles (EVs) are expected to account for approximately 84% of the overall lithium demand, which marks a notable increase from the 55% share observed in 2021.

The remaining demand for lithium is expected to be driven by consumer electronics, energy storage, and other industrial applications.

Moreover, the projected long-term demand for lithium is anticipated to surpass the current industry capacity by a significant margin. By 2040, it is possible that the monthly requirement for lithium could surpass the entire quantity mined in 2021.

Related Reading: Basic Principle and Working Process of Lithium Battery.

Lithium-Ion Battery Market Latest Trends

One of the latest trends in the lithium-ion battery market is the increasing adoption of lithium nickel manganese cobalt (NMC) batteries.

These batteries have a higher energy density and a longer lifespan than traditional lithium cobalt oxide (LCO) batteries, making them ideal for use in electric vehicles and other high-performance applications.

Another trend in the lithium-ion battery market is the rapid expansion of production capacity. Several companies, including Tesla, LG Chem, and CATL, have announced plans to expand their production capacity to meet the growing battery demand.

This increase in production capacity is expected to reduce the cost of lithium-ion batteries and make them more affordable for consumers. In addition, the use of lithium-ion batteries in consumer electronics continues to drive the market.

With the increasing demand for smartphones, laptops, and other portable devices, the demand for high-capacity and long-lasting batteries is also increasing. This has led to the development of smaller and more efficient lithium-ion batteries, now commonly used in various consumer electronics.

Who Are The Key Players In Lithium-Ion Battery Market?

The lithium-ion battery market has seen significant growth in recent years, particularly in Asia Pacific, where the growing sales of electric vehicles and the expansion of the consumer electronics sector drive demand for batteries.

According to historical data, lithium-ion battery prices have decreased over the years due to technological advancements, which have led to increased adoption of these batteries in various applications.

South Korea is currently the largest producer of lithium-ion batteries, with companies like LG Chem and Samsung SDI dominating the market. These companies have a significant market share due to their long-standing experience in the battery manufacturing industry, advanced technology, and strong supply chain.

Other key players in the lithium-ion battery market include Japanese companies like Panasonic Corporation and Sony Corporation and Chinese companies such as CATL and BYD. The Asia Pacific region dominated the lithium-ion battery market in 2020, accounting for more than 50% of the market share in the revenue.

The region is expected to continue to lead the market during the forecast period, driven by the increasing demand for electric vehicles and consumer electronics in countries like China and India.

You may also like our blog on The Global Energy Storage Industry Chain Explained.

Opportunities and Challenges in the Lithium-Ion Battery Market

Opportunities

Development of New and Advanced Battery Technologies

There is an opportunity to develop new and advanced battery technologies that can improve the performance and safety of lithium-ion batteries. For example, using solid-state electrolytes in lithium-ion batteries is expected to improve their safety and performance, making them more attractive to consumers.

Expansion of the Electric Vehicle Market

The electric vehicle market is expanding rapidly, which presents a significant opportunity for the Lithium-Ion Battery Market. As more consumers switch to electric vehicles, the demand for lithium-ion batteries is expected to increase significantly.

Growing Demand for Renewable Energy Storage Solutions

There is also an opportunity for the Lithium-Ion Battery Market in the growing demand for renewable energy storage solutions. Lithium-ion batteries are widely used in energy storage applications, such as solar and wind power systems. As more renewable energy sources are adopted, the demand for these batteries is expected to increase.

Challenges

Improving the Safety and Sustainability of Lithium-Ion Batteries

Safety concerns are one of the main challenges facing the Lithium-Ion Battery Market. Lithium-ion batteries have been known to catch fire or explode in certain situations, which can be a consumer safety concern. Additionally, there are environmental concerns related to the production and disposal of lithium-ion batteries, such as releasing toxic chemicals or generating electronic waste.

Reducing the Cost of Lithium-Ion Batteries

The high cost of lithium-ion batteries is another market challenge. Although these batteries have decreased over the years, they are still relatively expensive compared to other types of batteries, which can limit their adoption in certain applications.

Addressing Supply Chain Issues

The availability of the raw materials needed to manufacture lithium-ion batteries, such as lithium and cobalt, can be limited. This can lead to supply chain issues and price volatility, creating challenges for manufacturers and consumers.

Intensifying Competition

The Lithium-Ion Battery Market is becoming increasingly competitive, which can create challenges for smaller players. Larger companies are investing heavily in research and development to improve their products and gain market share, which can make it difficult for smaller companies to compete.

Frequently Asked Questions

Q: What is lithium used for?

A: Lithium is primarily used in rechargeable lithium-ion batteries, which power various electronic devices, from smartphones and laptops to electric vehicles and renewable energy storage systems. It is also used in certain pharmaceuticals and alloys for aerospace and industrial applications.

Q: Is lithium a good investment?

A: Whether or not lithium is a good investment depends on your investing goals and portfolio composition. Rising lithium-ion battery demand driven by the growth of electric vehicles is expected to push lithium consumption higher in the next decade, which may support prices.

However, forecasts can be inaccurate, and past performance never guarantees future results. Doing your research and only investing what you can afford to lose is important.

Q: Will lithium prices go up or down?

A: The price forecasts for lithium carbonate are mixed. Some analysts suggest lithium prices may ease in the coming years, while others indicate that prices may rise.

However, past price performance never guarantees current results, and analysts’ predictions can be inaccurate. It is important to conduct your research before making any investment decisions.

Q: Is there a futures market for lithium?

A: While lithium does not have a futures market due to its relatively small trading volume, the derivatives market CME Group offers lithium hydroxide futures based on price assessments published by Fastmarkets.

The LME also launched a reference price for lithium in partnership with Fastmarkets in 2019. The lithium spot price in China, Japan, and Korea is the industry benchmark for battery-grade lithium.

Q: Is there a supply shortage of lithium?

A: There have been concerns about a potential supply shortage of lithium due to the rapid growth in demand for electric vehicles and renewable energy storage systems. However, as of now, there is no significant shortage of lithium supply. In fact, between 2018 to 2020, lithium prices fell due to a supply glut as miners increased production.

You May Also Like:

- Low Temperature Batteries vs Lithium Iron Phosphate Batteries

- What Causes a Battery Failure | LiFePO4 Battery Failure

- Explore Ternary Lithium vs Lithium Iron Phosphate Batteries

- Why Tesla Chooses Cylindrical Over Soft Pack or Prismatic Lithium Batteries

- What is a 36V Li-ion Battery

- Commercial and Industrial Lithium Battery Applications

Share

- Ins

Senior Writer at Towsonbattery.com

William, a professional writer and battery energy expert with extensive experience in energy technology, able to provide clear and comprehensive presentations for both novices and experts in the energy field…

Towson Battery

Towson Battery